Allowable Charitable Deductions For 2024. Specifically, you can deduct charitable contributions of 20% to 60% of your adjusted gross income (agi). Here's how the cares act changes deducting charitable contributions made in 2020:

Choose tax regime wisely for tds, consider basic exemption limits, utilize tax rebates, deductions, and exemptions. Here is a rundown of these changes.

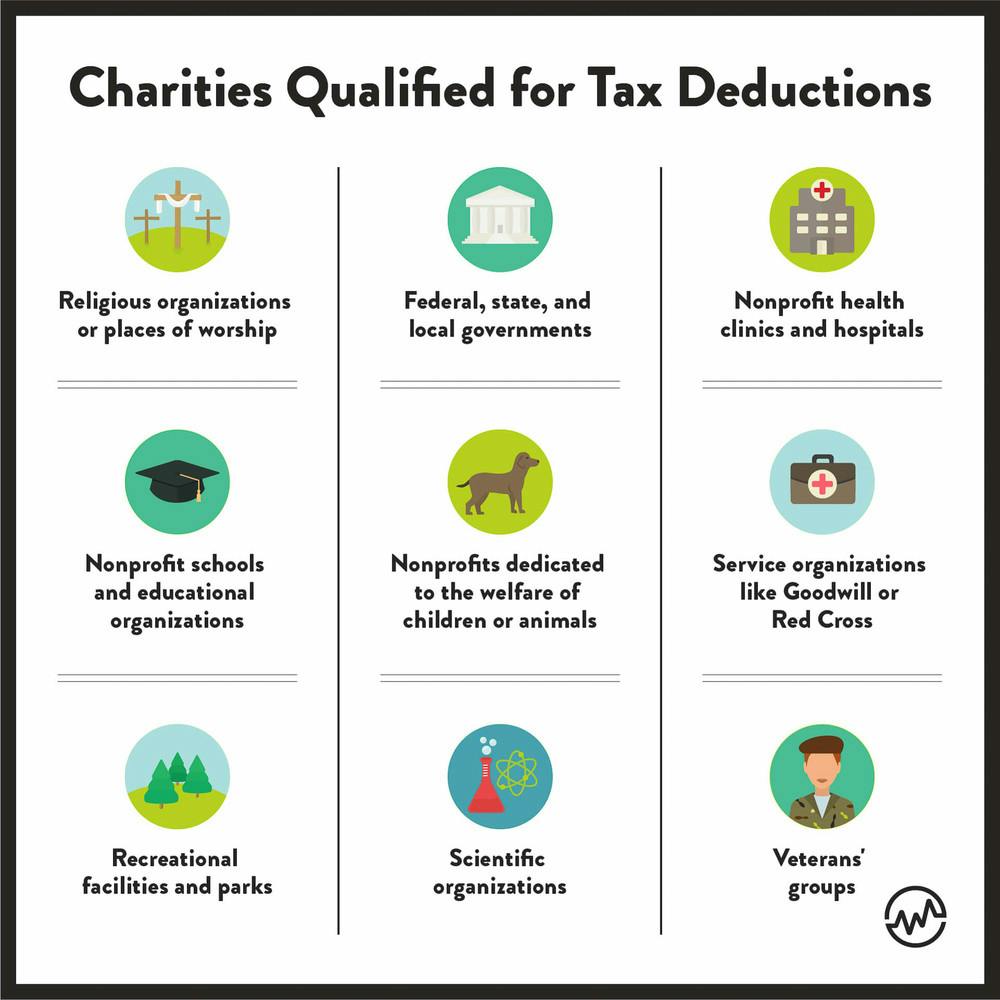

How to Maximize Your Charity Tax Deductible Donation WealthFit, This means that even if you’re subject to the amt, your charitable contributions can still potentially lower your tax liability. Only qualified organizations are eligible to receive tax deductible contributions.

How to Maximize Your Charity Tax Deductible Donation WealthFit, In addition to the intrinsic satisfaction of giving back, charitable contributions can also provide potential tax benefits—donors may be eligible to claim deductions on their tax returns, reducing their taxable income and lowering their overall tax liability. Table 1 gives examples of contributions you can and can't deduct.

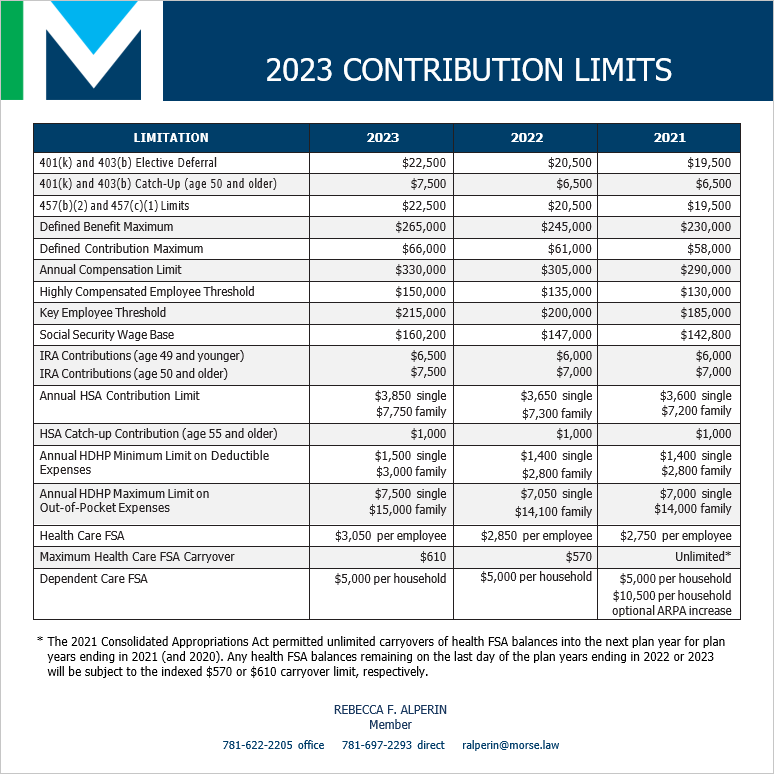

IRS Announces 2023 Contribution Limits for HSAs Ameriflex, These amendments, particularly in section 11 of the income tax act, 1961, bring about crucial alterations in deduction policies, corpus donations,. Many seniors can also take a tax break for.

Employee Benefit Plan Limits IRS 2023 Morse, These changes aim to balance the scales, allowing more taxpayers to benefit from their charitable giving, even if they choose the standard. If you decide to itemize your deductions, the irs limits how much charitable deductions can lower your taxes.

Why To Avoid 100OfAGI Qualified Charitable Contributions, The organization must qualify as tax exempt. The limit for appreciated assets in 2023 and 2024, including stock, is 30% of your agi.

Everything You Need To Know About Your TaxDeductible Donation Learn, There are many ways and places to give, but to. In the us, you can claim deductions on your federal tax returns for charitable contributions, typically capped at a maximum of 60% of your adjusted gross income (agi).

Everything You Need To Know About Your TaxDeductible Donation Learn, Each year, the irs adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax. Here's how those break out by filing status:

The Complete Charitable Deductions Tax Guide (2023 Updated), Cash contributions in 2023 and 2024 can make up 60% of your agi. Your charitable contributions must comply with federal tax rules designed to prevent improper deductions.

Charitable Tax Deductions by State Tax Foundation, These amendments, particularly in section 11 of the income tax act, 1961, bring about crucial alterations in deduction policies, corpus donations,. As a general rule, you can deduct donations totaling up to 60% of your adjusted gross income (agi).

Charity Deductions Taxed Right, If you aren’t taking the standard deduction , you’ll likely qualify for tax breaks for charitable donations and strategies that maximize them. The percentage of your deduction.

If you aren’t taking the standard deduction , you’ll likely qualify for tax breaks for charitable donations and strategies that maximize them.

Each year, the irs adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax.